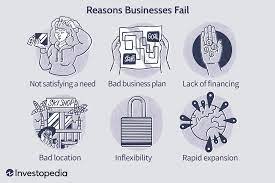

1. Reasons for Business Closure

Financial Challenges: Insufficient revenue, cash flow issues, or unsustainable financial structures leading to insolvency or bankruptcy.

Market Dynamics: Changing consumer preferences, technological advancements, or shifts in industry landscapes impacting business viability.

Strategic Decisions: Voluntary closures due to mergers, acquisitions, or strategic pivots aligning with new business objectives.

2. Impact on Stakeholders

Employees: Considerations for layoffs, severance packages, and support services for employees affected by the closure.

Customers: Communicating closures, addressing customer concerns, and ensuring adequate service or product alternatives.

Suppliers and Partners: Managing relationships, settling outstanding debts, and transitioning partnerships.

3. Legal and Regulatory Considerations

Compliance Requirements: Adhering to legal obligations, including settlements, contract terminations, and closure procedures.

Winding-Up Processes: Following regulatory protocols, formalizing closure procedures, and fulfilling legal obligations.

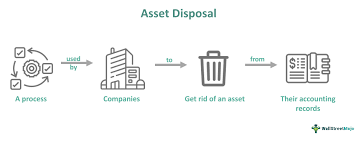

4. Financial and Asset Disposal

Debt Settlement: Settling outstanding debts, liabilities, and obligations to creditors, lenders, and stakeholders.

Asset Liquidation: Disposing of assets, inventory, or property through auctions, sales, or liquidation processes.

5. Communication and Public Relations

Stakeholder Communication: Transparent communication with employees, customers, suppliers, and partners about closure timelines and implications.

Reputation Management: Minimizing negative impact on brand reputation through tactful communication strategies.

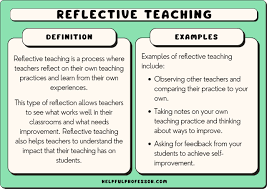

6. Post-Closure Reflection and Learning

Closure Analysis: Assessing reasons for closure, conducting post-mortem analyses, and identifying lessons for future endeavors.

Entrepreneurial Growth: Leveraging closure experiences as learning opportunities for future entrepreneurial endeavors.

7. Emotional and Psychological Impact

Owner/Founder Perspective: Coping with the emotional toll of closure, managing stress, and seeking support during this challenging phase.

Employee Well-being: Supporting employees through the emotional impact of job loss and offering resources for career transitions.

8. Entrepreneurial Community Support

Incubators and Networks: Accessing support networks, communities, or mentorship programs for guidance and potential new ventures.

Government Initiatives: Utilizing government assistance, programs, or resources for entrepreneurs facing business closures.

9. Transition Strategies and Exit Planning

Succession Plans: Developing strategies for business succession, especially for family-owned or closely-held businesses.

Exit Planning: Creating comprehensive exit plans, identifying suitable exit routes (selling, transferring ownership, or liquidating assets).

10. Financial Resolutions and Debt Management

Debt Restructuring: Exploring options for debt restructuring or negotiation with creditors to alleviate financial burdens.

Debt Settlement: Prioritizing debt repayment, negotiating settlements, and managing creditor expectations during closure.

11. Closure Strategies for Different Business Types

Small Businesses: Tailoring closure strategies for small businesses, including regulatory compliance, tax considerations, and employee support.

Startups: Navigating closure for startups, considering investor relationships, intellectual property, and winding-up procedures.

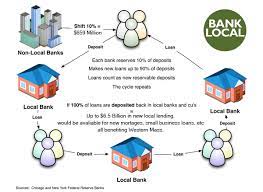

12. Impact on Local Economy and Community

Community Relations: Mitigating the impact on the local economy, addressing community concerns, and contributing positively despite closure.

Economic Implications: Assessing the broader economic impact, potential job losses, and effects on local supply chains.

13. Post-Closure Entrepreneurship and Rebound

Entrepreneurial Resilience: Leveraging closure experiences as lessons for resilience, innovation, and future entrepreneurial endeavors.

Rebound Strategies: Exploring avenues for rebound, including re-entry into the market with revised business models or new ventures.

14. Support Services for Affected Stakeholders

Outplacement Assistance: Offering outplacement services, career counseling, or job placement support for affected employees.

Financial Counseling: Providing resources for financial planning and support for individuals impacted by closure.

15. Learning from Closure Experiences

Business Analysis: Conducting comprehensive analyses of closure experiences, identifying key factors contributing to closure, and learning for future ventures.

Industry Insights: Sharing insights and experiences within the industry or entrepreneurial community, fostering learning and knowledge sharing.

16. Legal Consultations and Closure Protocols

Legal Guidance: Seeking legal counsel to navigate closure protocols, ensuring compliance with regulations, and minimizing legal risks.

Documentation and Records: Securing and organizing business documentation, financial records, and closure-related paperwork for future reference.

Conclusion:

The "business ender" is a critical phase in an entrepreneur's journey, demanding meticulous planning, emotional resilience, and ethical considerations. Embracing closure experiences as learning opportunities, supporting stakeholders, and contributing positively to the community can shape the narrative of closure, paving the way for future entrepreneurial endeavors with valuable insights and enhanced preparedness.

Navigating the cessation of a business encompasses various dimensions, from legal and financial considerations to community impact and personal resilience. Embracing closure experiences as learning opportunities and managing closure with integrity and care can pave the way for a positive and informed entrepreneurial future.

You must be logged in to post a comment.